Tariff Update: April 9, 2025

Steep new apparel tariffs are forcing fashion brands to overhaul pricing, supply‐chain strategies, and customer communication as they brace for rising costs.

This is a rapidly evolving situation and we will be updating regularly.

The global fashion industry is currently grappling with significant tariff increases that are reshaping international trade dynamics. Recent U.S. tariff hikes – 125% on Chinese imports for example, are particularly impactful, given that nearly 30% of U.S. clothing originates from China. While there are questions about what will ultimately “stick” and for how long, it’s imperative to be prepared and understand the wider competitive market.

Current List of Tariff Rates (April 9, 2025, 3pm ET)

These tariff measures will lead to increased production costs, compelling brands to adjust pricing strategies and reassess supply chains. So let’s make a few clarifying points on the topic of tariffs, as well as examine any new developments in pricing by brands and retailers.

The Current Situation

In fashion, the answer—for now—is that we’re largely in a wait-and-see phase. Many brands are still selling through landed inventory, meaning the products currently on shelves and available online reflect pre-tariff pricing. Additionally, many brands implemented price increases in Q1—an expected move as part of routine annual adjustments. The real test will come as new inventory starts to arrive under the new tariff structure. That’s when we’ll begin to see whether and how prices shift.

Now is the time to start tracking competitor pricing closely, especially for specific SKUs and categories. Early detection of price movement will give you a strategic edge in responding quickly and adjusting your own pricing or messaging.

One nuance worth remembering: tariffs are applied to the declared import value, not the wholesale or retail price. So, for example, if a shirt has a declared value of $20 and a retail price of $40, a 25% tariff adds $5 to the cost—not $10. If that $5 is passed entirely to the consumer, the retail price increases by 12.5%, not 25%. That distinction is crucial. It offers brands flexibility—not only in how they absorb or distribute cost increases, but also in how they communicate any pricing changes to customers.

Speaking of communication, most fashion brands have not yet addressed potential price increases with consumers. But there are exceptions. Smaller, independent brands like Labucq, a New York-based footwear label, have started to proactively inform their customers. Just last week, the brand’s founder shared a note explaining upcoming price adjustments. This kind of transparency could set the tone for how brands navigate customer expectations in the months ahead.

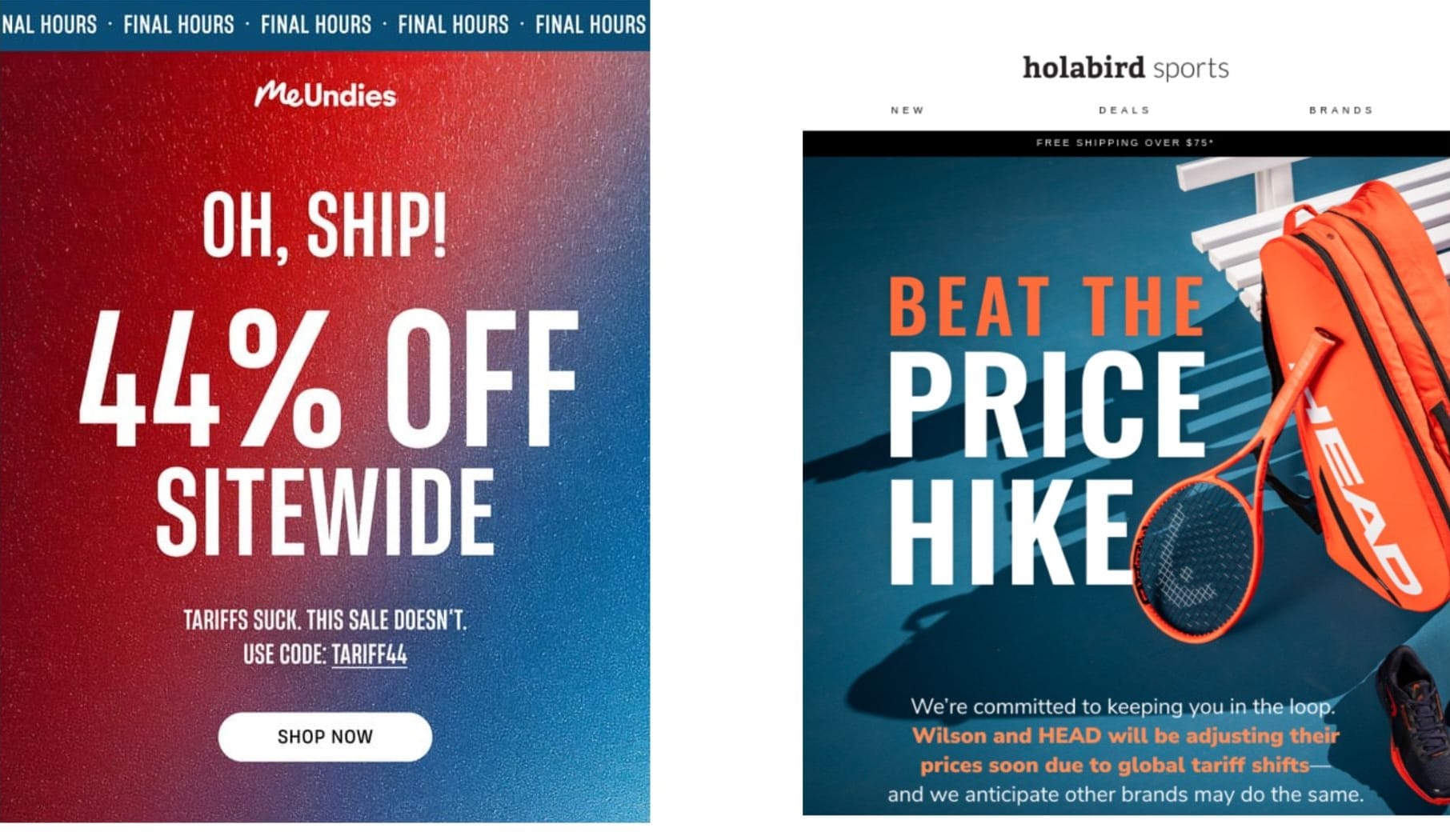

Other brands have had a more cheeky take on all the tariff drama, including MeUndies, which used the moment to offer up a tariff-related discount. Other brands like Holabird urged shoppers to “beat the price hike” on their home page.

Sector-Specific Highlights

The tariff escalation will likely have notable repercussions across various segments:

Mass Brands: Already, it’s been reported that Walmart is pushing its suppliers to cut their costs to offset the impacts of tariffs. This request has posed challenges for Chinese manufacturers, many of whom are already operating on thin profit margins. Despite Walmart’s efforts to diversify its supply chain since Trump’s first term, China remains a crucial source for products like clothing, electronics, and toys.In March, Beijing officials met with Walmart representatives to discuss the retailer’s pricing demands in light of the tariffs.

In short, low-margin, high-volume brands are in a tight spot. Without the pricing flexibility of premium players, they must make difficult choices—either absorbing the hit, cutting costs aggressively, or risking losing customers through price increases. This environment may force consolidation or accelerate innovation in logistics and sourcing.

Luxury Brands: High-end labels like LVMH, Kering, and Burberry have seen stock declines amid an already challenging retail environment. Consumer demand has softened, especially among aspirational shoppers who’ve been priced out by years of aggressive price increases. With China—once a growth engine—still showing lukewarm demand, the outlook for 2025 was cautious even before tariffs entered the picture.

How might luxury brands respond? With high margins and strong brand equity, they have more flexibility than most to absorb or pass on cost increases. Regular price hikes, especially for iconic items, are already a standard part of luxury pricing strategies. As a result, tariff-related adjustments could be seamlessly integrated into regular price reviews with minimal customer pushback. Currently, as shown in the index below, brands have yet to implement price hikes. It’s likely that any increases will occur as part of their ongoing pricing evaluations.

Rather than justify higher prices through cost breakdowns, many luxury players may lean into messaging that emphasizes craftsmanship, exclusivity, and heritage, reinforcing value perception and avoiding any direct mention of tariffs.

One trend to watch: price-sensitive U.S. shoppers may increasingly delay big-ticket purchases until they travel abroad—especially to Europe—where pricing will be more favorable. This behavior, already common in the post-COVID travel boom, could intensify as domestic prices rise further.

Jewelry Sector: Even before the latest tariffs, gold prices had been steadily climbing. On April 2, 2025, gold futures for April delivery closed at a record $3,139.90 per troy ounce, marking a 19% increase over the past year. This surge is largely driven by investors and central banks seeking a safe haven amid global uncertainty. For the fine jewelry sector, this creates a perfect storm: not only is gold more expensive, but most other key componen —such as gemstones—are also sourced internationally and subject to new tariffs. As a result, prices for fine jewelry are likely to rise sharply. Luxury houses like Cartier are already adjusting their pricing strategies to absorb these increased costs while striving to maintain customer demand and protect margins.

Footwear Brands: With a significant share of global footwear manufacturing based in countries like Vietnam, the sector faces particular vulnerability to rising costs from newly imposed tariffs. This is especially impactful given the industry’s reliance on lean margins and high-volume sales. While the sportswear segment remains resilient—buoyed by strong consumer interest and the rise of challenger brands taking share from legacy players—these tariffs introduce new friction into already complex global supply chains.

At present, our price index reflects stability, with no notable increases across bestselling footwear styles. This aligns with expectations, as many brands are still selling through pre-tariff inventory. However, as new shipments land and cost pressures mount, we anticipate that pricing adjustments may follow. We’ll continue to monitor key items closely in the weeks ahead for any signs of upward movement.

Small and Mid-Sized Enterprises (SMEs): Smaller apparel businesses are particularly vulnerable, with some pausing orders and implementing hiring freezes due to the financial strain imposed by the tariffs. The lack of negotiating power with suppliers exacerbates their challenges. As noted above, some brands are already taking to social or email, to let customers know there will likely be price increases coming down the line.

How to Track Price Movements and Stay Ahead of Market Shifts

Looking to refine your pricing strategy amid ongoing cost pressures and shifting market conditions?

One of the smartest first steps is to build structured product sets that allow you to monitor pricing trends over time. Focusing on core categories—those with consistent SKUs and minimal seasonal fluctuations—gives you a clearer lens into how the market is responding. These stable product groups act as a reliable benchmark for evaluating pricing strategies.

Tip: Filter for products introduced more than a year ago. This helps isolate long-standing items and filters out the short-term noise from recent launches or seasonal additions, providing a more accurate view of baseline pricing shifts.

Automate Your Market Monitoring

With solutions like Centric Market Intelligence, you can automate price tracking and receive real-time alerts when pricing changes occur. These notifications are delivered directly to your inbox, ensuring you’re always informed of key movements without having to manually check each update. It’s a simple yet powerful way to streamline your pricing surveillance and stay ahead of market shifts.

To learn more about how to tailor these alerts to your specific needs or to explore how real-time intelligence can support your strategy, contact us.

About Centric Software

Centric Software® (centricsoftware.com)

From its headquarters in Silicon Valley, Centric Software provides an innovative and AI-enabled product concept-to-commercialization platform for retailers, brands and manufacturers of all sizes. As experts in fashion, luxury, footwear, outdoor, home, food & beverage, cosmetics & personal care as well as multi-category retail, Centric Software delivers best-of-breed solutions to plan, design, develop, source, comply, buy, make, price, allocate, market, sell and replenish products.

- Centric PLM™, the leading PLM solution for fashion, outdoor, footwear and private label, optimizes product execution from ideation to development, sourcing and manufacture, realizing up to 50% improvement in productivity and a 60% decrease in time to market.

- Centric Planning™ is an innovative, cloud-native, AI solution delivering end-to-end planning capabilities to maximize retail and wholesale business performance, including SKU optimization, resulting in an up to 110% increase in margins.

- Centric Pricing & Inventory™ leverages AI to drive margins and boost revenues by up to 18% via price and inventory optimization from pre-season to in-season to season completion.

- Centric Market Intelligence™ is an AI-driven platform delivering insights into consumer trends, competitor offers and pricing to boost competitivity and get closer to the consumer, with an up to 12% increase in average initial price point.

- Centric Visual Boards™ pivot actionable data in a visual-first orientation to ensure robust, consumer-right assortments and product offers, dramatically decreasing assortment development cycle time.

- Centric PXM™, AI-powered product experience management (PXM) encompasses PIM, DAM, content syndication and digital shelf analytics (DSA) to optimize the product commercialization lifecycle resulting in a transformed brand experience. Increase sales channels, boost sell through and drive margins.

Centric Software’s market-driven solutions have the highest user adoption rate, customer satisfaction rate and fastest time to value in the industry. Centric Software has received multiple industry awards and recognition, appearing regularly in world-leading analyst reports and research.

Centric Software is a subsidiary of Dassault Systèmes (Euronext Paris: #13065, DSY.PA), the world leader in 3D design software, 3D digital mock-up and PLM solutions.

Centric Software is a registered trademark of Centric Software, Inc. in the US and other countries. Centric PLM, Centric Planning, Centric Pricing & Inventory, Centric Market Intelligence, Centric Visual Boards and Centric PXM are trademarks of Centric Software, Inc. All third-party trademarks are trademarks of their respective owners.

Explore Centric’s AI market-driven solutions

Optimize each step of bringing a product to market, whether at the pre-season, in-season or end-of-season cycle. Streamline processes, reduce costs, maximize profitability and drive sustainability.

Centric Pricing & Inventory

Centric Pricing & Inventory

Centric Market Intelligence

Centric Market Intelligence

Centric PXM

Centric PXM